Surviving Ocean Freight, Tariffs, and Geopolitics

Tariff Update:

The newly announced U.S. “reciprocal” tariffs have been mostly postponed for 90 days to allow time for further discussions and negotiations. This delay is set to expire on July 8. It’s uncertain whether another extension will follow or if tariff changes will take effect. Agreements may still be reached, but for now, businesses should prepare for any outcome.

China Exception:

China is the notable exception. The U.S. has already enforced new tariffs on Chinese goods, many of which now exceed 200%. In response, China has implemented retaliatory tariffs of 125% or more on U.S. imports. However, certain product categories have been excluded from these tariffs by both countries. Regardless, a base tariff of 10% applies broadly.

Other Key Updates

Shipping Updates

- China-made vessels: The U.S. is planning to introduce fees on Chinese-built vessels starting October 2025, with annual increases over the next three years. Fees will be charged per voyage, not per port. China-based carriers (e.g., COSCO, OOCL) will also face a 300%+ premium on top of vessel fees.

- Rationale: The U.S. justifies these measures by citing China’s long-standing ambition to dominate global ocean logistics—from shipbuilding and crane manufacturing to container production and port operations.

- Hutchison Ports: The proposed $22.8 billion sale of 43 ports to a BlackRock-led consortium remains on hold, pending review by China’s antitrust agency.

Market Trends

- Importers rushing shipments: Many U.S. importers are accelerating shipments to beat the July 8 tariff deadline.

- Soft market: Volumes from China to the U.S. are weak, with no space shortages reported. Carriers are blanking (canceling) a high percentage of sailings.

- Blank sailings: As much as 60% demand drop of sailings from China to the U.S. and 30%+ capacity cut using Blank sailings.

- Increase reported from Southeast Asia to US of 15%+ offsetting half of the China demand drop.

- Delayed contract starts: Many shippers are postponing Transpacific contract start dates from May 1 to later in May or June, hoping to leverage the current volume dip.

- Global PMI trends: Global purchasing managers’ indices are hovering around 50, with forecasts suggesting a drop below 50 during 2025. Eurozone consumer demand has weakened.

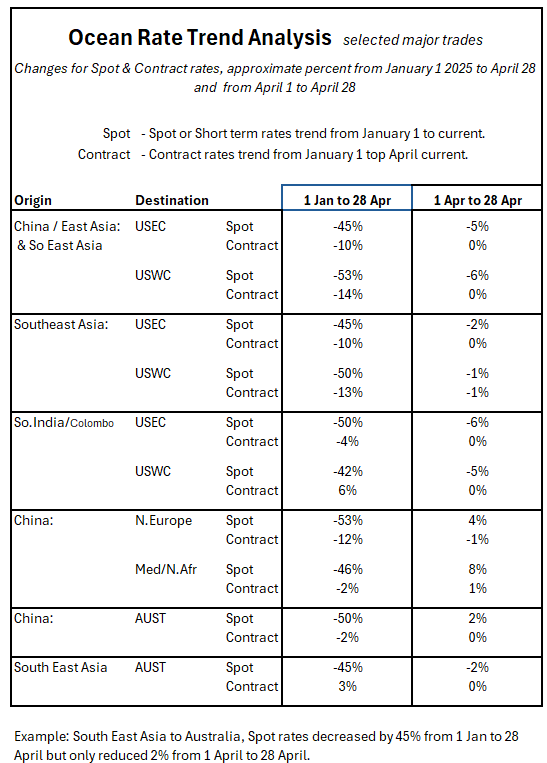

Rates & Service Analysis

General Trends

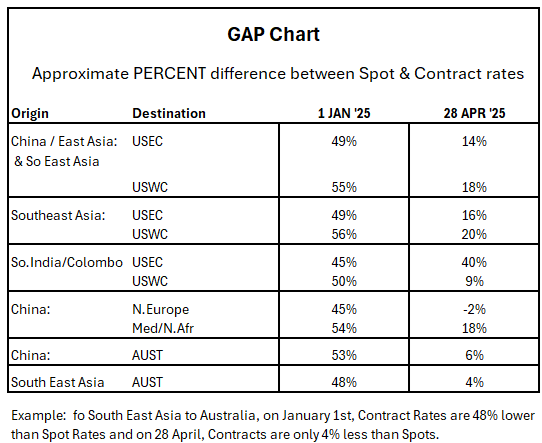

- Rates: Global rates continue to decline across both spot and long-term contracts. Currently, contract rates are below spot levels in many lanes.

European Port Congestion

Major North European ports, especially Rotterdam and Antwerp, face significant congestion due to:

- High import volumes and strong demand

- Terminal capacity limitations (full container yards, berth delays)

- Disruptions (e.g., crane maintenance, rail bottlenecks, low water levels)

- Labor unrest and staffing shortages

China’s 17.6% year-on-year export growth to North Europe has worsened congestion. These delays are expected to persist into the coming months.

Far East Westbound (FEWB) – Asia to Europe & Mediterranean

Supply & Demand:

Demand remains flat to soft, while supply is steady. European congestion, fueled by past volume surges, has led carriers to use blank sailings to manage capacity and protect rates.

Rates:

- Spot rates have fallen 50–55% since January 1.

- Current spot rates to North Europe are now close to contract rates.

- To the Mediterranean, spot rates remain higher than contract rates—though the gap has narrowed.

- Med contract rates are about 5% higher than Asia–North Europe lanes.

Transit & Reliability:

- Red Sea/Suez disruptions continue, extending transit times by 2–3 weeks.

- Carrier “on-time” reliability has improved to near 2024 levels but doesn’t reflect blank sailings or port congestion delays.

- True reliability for BCOs must include deviations from originally planned sailing dates—not just arrivals at destination ports.

Asia to U.S. / North America – Transpacific Eastbound (TPEB)

Supply & Demand:

Tariff-driven demand from China has plummeted—down 50–60%—prompting a surge in blank sailings. However, a sharp increase in orders is expected leading up to the July 8 tariff deadline.

In contrast, exports from non-China East and Southeast Asia to the U.S. are up 15–20%, offsetting some of the China volume decline.

Rates:

- Spot rates have fallen sharply since January, despite a temporary bump from April GRIs (General Rate Increases).

- Spot rates were initially 50% higher than contract rates, but the gap has narrowed to around 15%.

- With major contracts now in place and demand still weak, spot rates could dip below contracts in the open market.

Transit Reliability:

- Transit times are improving, particularly from Asia to the U.S. West Coast. East Coast routes are improving too, but still lag behind.

- However, blank sailings significantly disrupt schedules. These disruptions often don’t appear in public reliability metrics but must be considered by shippers when evaluating true performance.

See Ocean Rate Trend analysis and GAP analysis tables below:

Wrap-Up

WOW! Or better yet—WOWL!

The global ocean freight market remains as wild and unpredictable as ever. From Suez Canal blockages to COVID shutdowns and now a brewing tariff standoff, the supply chain continues to surprise us.

At WOWL, we’re here to help you make sense of the chaos—with insight, data, and tools to adapt in real time.

Stay prepared, stay informed, and stay in control.