Tariff Update:

The newly announced U.S. “reciprocal” tariffs have been mostly postponed now for China as well as most other countries. The China pause will be to about August 12 and we expect this 90-day pause will turn into a firm agreement before the time expires.

Other countries have already been on a 90-day pause that should end in early July. Some negotiations have already been agreed to in principal (US & UK). Many other countries are hoped to conclude agreements with the US prior to the deadline.

US & China/HK agreement as of May 12 agreed to the following terms:

- 90-day tariff reduction agreement between US and China, effective May 14, 2025.

- US reduces tariffs on China from 125% to 10% for 90 days.

- US fentanyl tariff also remains at 20%, making effective 90-day tariff rate 30%.

- China reduces retaliatory tariffs from 125% to 10%.

- 301 tariffs are still in effect. The tariffs above are stacked onto any current 301 tariffs.

- De Minimis: The US reduced tariff on items $800 or less from 120% to fifty-four% and Canceling the $200 flat fee increase.

- Long-term trade agreement negotiations start soon.

- Exceptions like the Iron & Steel tariffs by the US still remain in place.

Warning - always consult your trade & customs experts for the specific applications for your imports and exports.

Market Topics:

- Surge of shipping is expected now for the backlogged orders from China Many shipments have been ready and waiting to be sailed.

- Market Update - Quoted from noted industry expert: “Everyone rushes to get cargo out now and push the factory to resume production fast, catching the 90-day window. Cosco has closed the May ETD sailing window. One of our customers was being canceled 43 Feu even though we had gotten the shipping order on hand and released it to the shipper. One of the reasons would be carriers expected the shortfall ratio will be greatly reduced and need to control...”

- Increase shipping from Southeast Asia to US of 15%+ has already been happening since past month.

Rates & Service Analysis

General Trends

- Rates: Global rates continued to decline across both spot and long-term contracts. Into May. Expecting China and other TP East shipping spot rates to increase with the restart of China to US volumes. Already reports of equipment shortages and full bookings out of China to the US. Spot rates are said to be increasing 15-20% now.

European Port Congestion

Major North European ports are still impacted by volumes and congestion on their import caused by high import volumes; terminal capacity limitations; labor issues and other disruptions with equipment and infrastructure.

Far East Westbound (FEWB) – Asia to Europe & Mediterranean

Supply & Demand:

Demand remains flat to soft, while supply is steady. European congestion, fueled by past volume surges, has led carriers to use blank sailings to manage capacity and protect rates.

Rates:

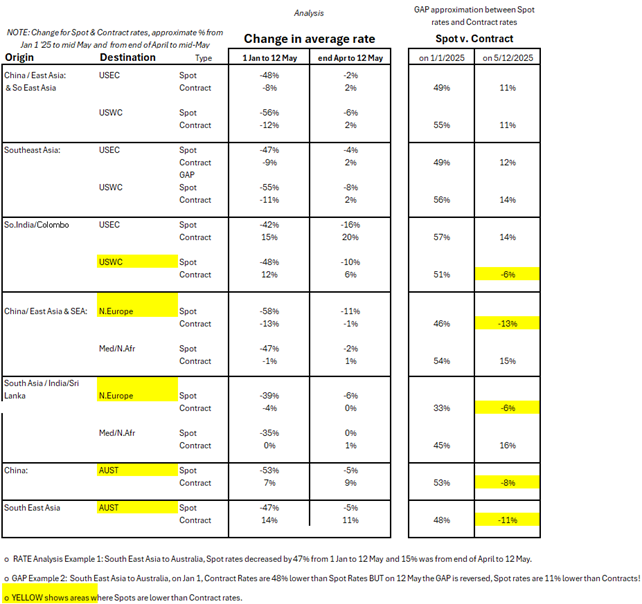

- Spot rates have fallen 50–55% since January 1.

- Current spot rates to North Europe are now close to contract rates and trending further downward.

- To the Mediterranean, spot rates remain higher than contract rates—though the gap has narrowed. Rates are trending downward.

- Med contract rates are about 5% higher than Asia–North Europe lanes.

Transit & Reliability:

- Red Sea/Suez disruptions continue but a “peace” or “cessation of aggression agreement is announced. We are all waiting to find out if it is trusted and the Suez Canal can again be used on East/West Ocean transport. That will reduce transit times by 2–3 weeks per shipment.

- Suez Canal availability also impacts N. America East Coast Asia shipments with faster service versus rounding Africa.

Asia to U.S. / North America – Transpacific Eastbound (TPEB)

Supply & Demand:

Tariff-driven demand from China had plummeted down prompting a surge in blank sailings. However, a sharp increase in orders waiting to sail are now expected with the announced a new 90-day agreement between the US & China.

Expectations are that the two countries will settle disputes at the current temporary levels before the 90-day agreement expires.

In addition, exports from Other East Asia and Southeast Asia countries to the U.S. are up 15–20% since last month..

Rates:

- Spot rates have fallen sharply since January, despite a temporary bump from April GRIs (General Rate Increases). Rates started decreasing again the first two weeks of May.

- Spot rates were initially 50% higher than contract rates, but the gap is now narrowed to around 11%.

- Expect Spot rates to soar higher again on the TransPacific East trade with the 90-day agreement in place. Space will likely be at a premium for the next few months. New reports just in are for 15-20-% increase in spot rates from China to US!

- Blank sailings should be much reduce with this expected volume surge.

💡

Tip: A shipment’s reliability should factor in both actual and originally planned sailing dates to identify meaningful variances.

See the Ocean Rate Trend analysis and GAP analysis tables below:

Wrap-Up

The global ocean freight market on two of the largest value trades, TransPacific and Asia-Europe, will have Europe still congested with volume and delays as well as the TP roaring back this week and in the following weeks as China starts shipping Eastward again. The best advice seems to be to continue to be alert for changes as they are coming more often than ever.

At WOWL, we’re here to help you make sense of the chaos—with insight, data, and tools to adapt in real time.

Keep Calm and Carry On!