The ocean freight market continues with significant shifts due to many factors. But first, the update on the US tariff programs.

Tariff Update

The US Court of International Trade (CIT) has ruled that the Trump Administration overstepped its authority under International Emergency Economic Powers Act ( IEEPA) by imposing tariffs on a broad set of imports. This decision applies to all importers, not just the plaintiffs. However, it is now "stayed" by the Appeals Court so it is not yet in effect.

The CIT court decision did block the following tariffs:

- 25% fentanyl tariffs (Canada & Mexico)

- 20% fentanyl tariffs (China)

- 10% across-the-board reciprocal tariffs (all countries including China)

- Additional reciprocal tariffs scheduled to take effect on July 9 (select countries) & August 10 (China)

What happened next? The government has appealed the CIT’s ruling and been granted an emergency stay and allows the IEEPA tariffs to remain in place until they rule. A resolution may take several years unless the court fast-tracks the appeal.

We should not expect any refunds on duties already paid for these tariffs until the issue is fully resolved. This could take years.

What continues to stay:

- The China de minimis ban

- Section 232 tariffs (e.g., steel and aluminum)

- Section 301 tariffs from Trump’s first term

These all remain in place and in effect.

If the Trump administration does lose the case, there are other laws available that they could use to prop up these same tariffs. Again, this could add years to the tariff issues and if the expectation that all the tariffs will be negotiated and in place with partner countries, the issue likely will be moot.

As for China specifically, there are other tariff levers available to use as long as China is continued to be seen as an aggressor and combatant of sorts with the US. Hopefully, this China/US situation will also resolve and we can work together again in harmony.

Reach out to your Trade & Customs experts for exact impact and data.

Market Trends

- Transpacific Demand Surge: overwhelming carrier capacity, with week-over-week booking volumes up by over 50%. Some ports are well past capacity.

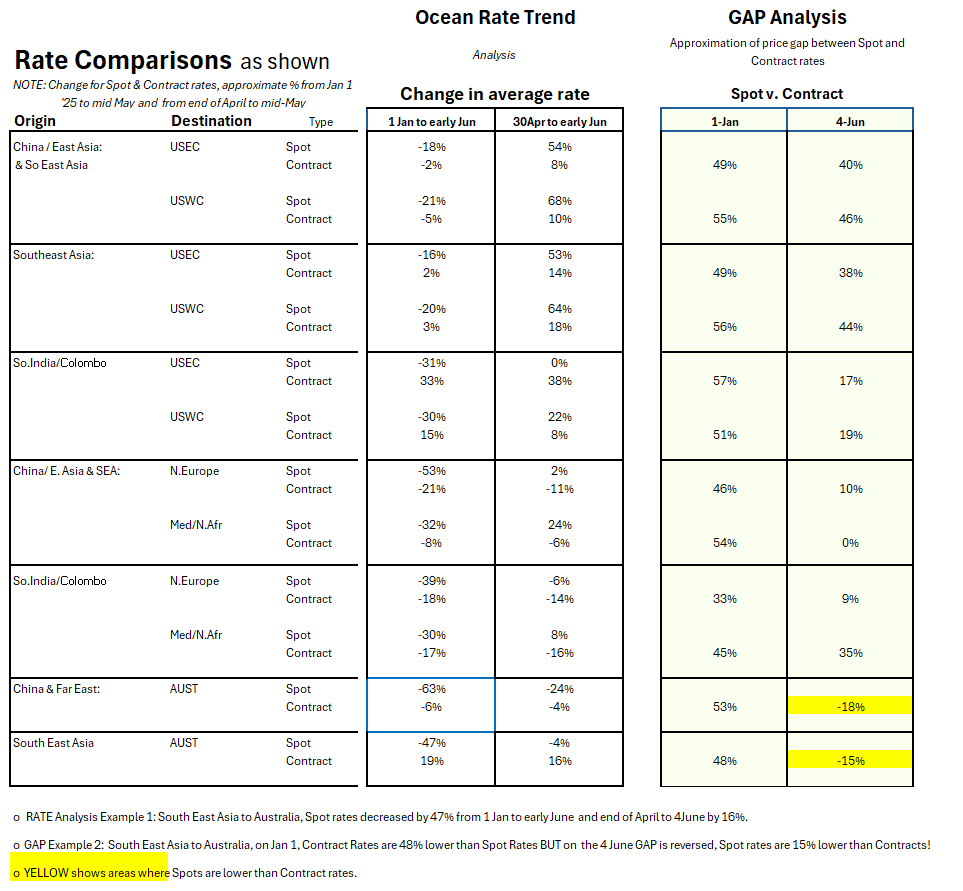

- Transpacific Rate Increases: General Rate Increases (GRIs) are quoted as expected to take effect on June 1, 2025, on all shipments from Asia and the Indian Subcontinent to the US and Canada. Post-GRI rate levels for Short Term/spot rates expected for June are predicted to be:

- $6,000-$6,500 to the US West Coast (USWC)

- $7,000-$7,500 to the US East Coast (USEC) and Gulf ports

So far, spot rates indexes for June are below the above predictions so far! A more practical level: USWC $4400-$4700 and to USEC $5200-$5600 (all rate estimates are in 40ft cntr)

- Capacity Restoration: carriers are working fast to reintroduce suspended services and add extra loaders for the TP.

- Carrier Strategies: Carriers are using various strategies to manage capacity, including:

- Slowing carrier confirmations on bookings and even S/O (Shippers' Order)to delay or cancel space releases.

- Implementing the aforementioned Peak Season Surcharges (PSS) or General Rate Increases (GRI) to manage demand and profits.

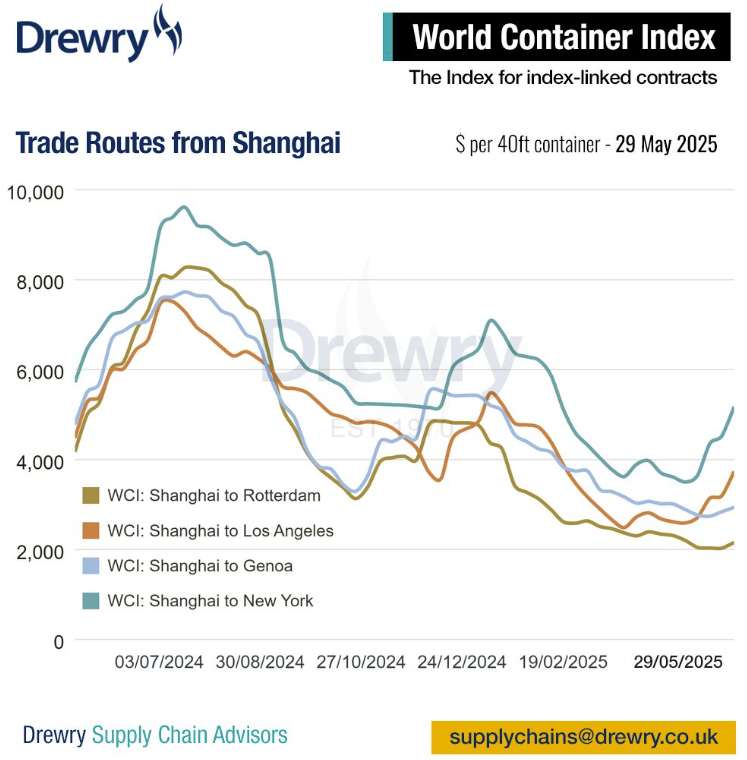

Courtesy of Drewry Advisors

Challenges

- Tariff Reprieve Ending: The current 90-day tariff reduction on Chinese goods expires on August 14, 2025, leading to a rush to ship goods before the deadline.

- Global Supply Chain Disruptions: The ongoing impact of geopolitical tensions, severe weather events and ongoing port or dray/trucking related labor issues especially in North Europe & UK ports.

Regional Insights on Ports

Asia:

Key ports in Asia, including Shanghai and Ningbo, and other China ports including Hong Kong are experiencing significant delays, with over 120 vessels anchored off these ports awaiting berths.

- Ports in South East Asia and South Asia are also reporting congestion and delays including Singapore, Port Kelang, Colombo Chittagong, and Mundra.

- Factories are continuing to rush to ship goods before any further new US Tariffs or restart of delayed US tariffs.

- Equipment shortages are a concern in some ports, especially in China such as Shenzhen.

Europe:

Ports like Hamburg, Rotterdam, and Le Havre are struggling with labor shortages and high volumes of traffic, leading to berth delays of up to 10 days.

The European Union's Emissions Trading System (ETS) will increase carrier cost. Stricter emissions standards, such as the EU's Fuel EU Maritime regulation, are reshaping shipping practices.

North America:

- Heavier impact on the USWC & West Coast Canada

- Port congestion delays from volume increases of +25 compared to last year.

- Expect delays due to the reshuffling of carrier alliances and tariff changes.

- Shortages of equipment and drivers for dray carriers.

- Port of Manzanillo MX severe backlog after a port strike earlier in May.

Market Outlook

To US & Canada: Freight rates are expected to increase due to capacity constraints and increased demand on the Transpacific and Transatlantic trades to US & Canada. But not so much on the return voyages though.

Asia to Europe: the carriers would like to get more increases although historically the rates are much higher than pre-Covid levels and most of the rates over the past decade.

Red Sea Diversions are still hopefully reverting to the normal voyages through the Suez Canal and eliminating the “around Africa” trail. This will add an estimated 5-10% capacity with the faster transit times to global container capacity.

Intra-Asia: trade continues to plug along smoothly with stable rates and capacity.

Future Rate Trends and Forecasts:

- Spot rates may peak early and soon. PSS started early. Usually, it starts end of July and through November at least. This year, it all could be over by August.

- Contract rates remained relatively flat versus the prior year. Carriers will use the short term/spot markets to pad their margins.

- Shippers still frontloading shipments ahead of PSS & GRI impacts and feared tariffs.

Recommendations

- Plan shipping 4-6 weeks in advance, alert carriers/forwarders of your plans.

- Book 3-4 weeks prior to your desired sailing dates but ensure you confirm those booking. Many will not confirm bookings more than 2 weeks from sailing.

- Premium Options with carriers are available but costly.

- Prepare for delays. These things happen even in good times.

- Diversify your supply chains. It is an increasingly popular discussion among corporate leaders!

Rate Trends Analysis

We will continue to provide updates on the market conditions within the WOWL.io website and if you are registered for our newsletter, we will email it out to you as they are published.

If you are still not signed up for the newsletter email, you can do it via WOWL.io. It free of charge!

What does WOWL do? Ask for an explanation via the Demo request! That is free too.