Imports and new orders for imports for the US are drying up as we approach the traditional peak season period. For the Transpacific trade, it looks like the peak season may have peaked over the last two months with many importers bringing in inventory from offshore to beat the new tariff threats. But for Asia-Europe, their peak came early and continues still.

Critical Points:

The global ocean market is experiencing significant changes due to ongoing trade tensions, capacity management, and shifting demand patterns. Some trades are heavy demand and other key trades are softening quickly.

- Tariff Uncertainty: The on-again, off-again US tariff implementation has resulted in a whiplash effect, with businesses struggling to adapt.

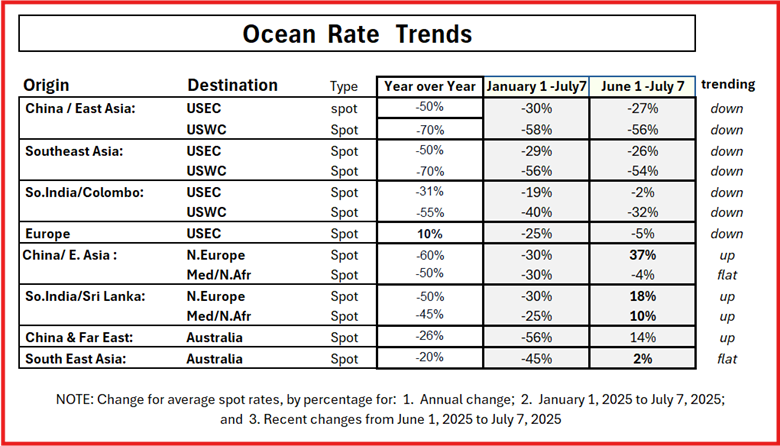

· Spot Rate Trends: significant fluctuations due to changes in demand, capacity, and trade policies. Some trades are up, and others are dropping fast.

Transpacific are falling with drop in demand and over capacity while Asia – North Europe increasing rates regularly with strong demand and continuing port congestion.

- Global Schedule Reliability generally has improved each of the last four months with the new alliances shaking out startup issues as well as smoothing operations for new or changed service string changes.

- Carriers are aggressively attempting to manage capacity to mitigate dropping rates or areas of heavy demand. Blank sailings and new vessels entering service are making impacts.

- Import Expectations: Reports are that US retailers downgraded import expectations for September to 1.78 million TEUs, a 21.6% drop compared to last year.

· General Rate Increases (GRI’s) and a PSS announced first in early June, then postponed for the first half of July, have quietly disappeared as Transpacific demand has withered. But the Asia-Europe took the increased rates in a tight demand environment.

Other Global Concerns

· Suez Canal: Recent restart of incidents have caused disruptions, and the ripple effects are still being felt in European ports.

· Southeast Asia: Pirates are back! Piracy and armed robberies have increased 83% in the first half of 2025 compared to first half of 2024, particularly in the Straits of Malacca.

Ocean Rate Trend Analysis

Far East Westbound (FEWB) – Far East Asia to Europe & Mediterranean

Supply & Demand: Carriers on Asia-North Europe are deploying a record 1.15 million TEUs in capacity in July. In August, the deployed capacity will drop by 10% cutting about 100,000 TEUs from this market.

Asia-to-Europe container shipments have shown steady growth, with a 6% year-over-year increase in July 2024, driven by demand for consumer goods.

Rates: Spot Rates Surge: Shipping rates between Asia and Northern Europe have increased significantly, reaching their highest point in 2025. Spot rates for a 40-foot container from China to North Europe is up 21% week-over-week and more than double compared to early May.

Rate Increases: This week in July, rates from the Far East into North Europe are more than 35%, and the Mediterranean are down by 4-5% compared to June 1.

Trends: Stabilizing Demand: Trade volumes are stabilizing, and fuel costs are relatively contained.

Growth in Demand: The trend suggests continued growth in demand for consumer goods, which could drive rate increases.

Concerns: Severe port congestion in the Mediterranean and Northern Europe is crippling vessel turnaround, with carriers fully booked through July and early August. Port congestion is created from issues including congestion delays, labor struggles, low river water, and equipment shortages.

Asia to U.S. / North America – Transpacific Eastbound (TPEB)

Supply & Demand: The extra capacity carriers added in early April as the market spiked quickly was withdrawn recently with the quick drop in demand.

Rates: Spot rates from the Far East to the US West Coast have fallen sharply, more than 50%, due to weaker demand. Spot rates are very close to contract rates now.

For the Far East to the US East Coast rates have dropped by over 25% over the last 6 weeks. There is still a solid gap between Spot rates and Contract rates but much smaller that the gap of only a few weeks ago.

Capacity: remains strong even though capacity has been withdrawn with the softening demand.

Other Key Trade Lanes

North Europe to US East Coast Trade

- The market average has stayed flat lately although its down about 25% from the start of the year.

- Carriers are managing capacity to mitigate congestion and delays of the major European ports.

Indian Subcontinent to North America

- Capacity to the US East Coast is increasing as the traditional ISC peak season begins.

- Capacity to the US West Coast has become available again, driven by a sharp increase in overall capacity into the TPEB market.

Asia-Pacific Trade

- The Asia-Pacific container market is expected to see steady growth in volume and value over the next decade, especially from demand for consumer goods.

- Tight capacity on key air and ocean lanes, shifting trade flows, and the looming tariff deadlines are concerning shippers and freight forwarders.

- Port congestion and booking lead times are significant concerns in Australia and India, and Middle East tensions also adding worries.

Ports Update by Region

Europe Ports

· London Gateway: Major operational disruptions, system failures, power outages, equipment shortages, and even rail network problems have caused significant delays.

· Rotterdam: Congestion and delays are expected, possibly leading to disruptions in port operations.

· Hamburg: Congestion persists, with vessels experiencing delays and equipment shortages.

· Bremerhaven: Operations are out of balance due to the ripple effects of global disruptions.

Northern European ports congestion is expected to remain a significant issue at lease for a few more months.

North America Ports

West Coast is still experiencing congestion especially the Port of Los Angeles. The other ports continue to have Rail Dwell time issues.

East Coast Ports have some level of congestion and delays are impacting services. Port of New York had several months of some terminals overloaded with empty containers preventing the return of more empty containers.

Port of Manzanillo, Mexico" The Custom workers strike at Manzanillo port officially ended the end of June, but the port is still dealing with backlog and reduced staffing is impacting overall productivity.

Asia Ports

· Singapore: Wait times extend up to 7 days due to increased exports from China and rerouting of ships. Normally wait times are only 1-2 days at most.

· Shanghai: Congestion is causing delays and strain on the global supply chain.

· Yantian/Shekou/Nansha: Delays occur due to restricted port operations.

· Kaohsiung (Taiwan): Ships avoiding this port due to China tensions, increasing export dwell days to 8-9 days.

· Colombo Port: Past congestion has recently resolved. Capacity expansion of the port improves imminently when West Container Terminal soon becomes operational and then later this year when the next phase, East Container Terminal also starts operations.

We hope this is useful information to you and please forward any questions or comments to AndyG @WOWL.io

Think of WOWL as a logistics partner in supporting your end-to-end global supply chain. Ask for a demo! It’s easy and free.