As we enter the final shipping peak of 2025, several critical developments may affect supply chain planning. These are some of the hot issues in the global ocean market:

1. Tariff-Related Front-Loading: Demand is adjusting downward quickly after the front-loading of wave of cargo in May and June due to the threats of reciprocal tariffs.

2. Port Congestion: Significant congestion in North European ports, such as Rotterdam and Antwerp, with average vessel dwell times extending three to five days.

3. Carrier Capacity Management: Carriers managing capacity through blank sailings and adjusting vessel deployments. This will negatively impact recent reliability improvements.

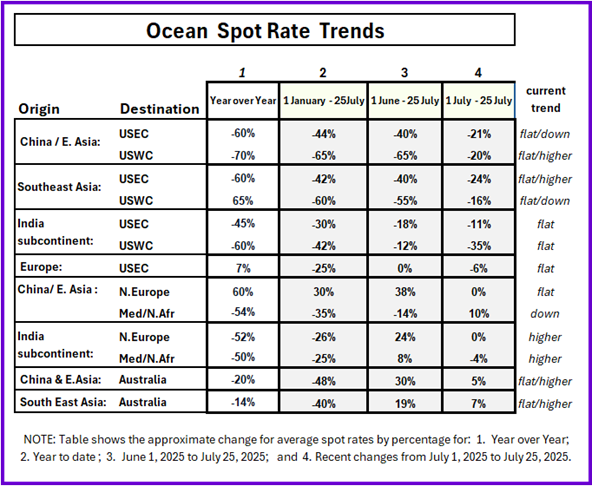

4. Rate Pressure: Rate pressure is expected to continue, higher rates on Asia-Europe probable but lower or flat rates on the Transpacific Eastbound routes. Other trades also having flat or lower rates as extra capacity leave Transpacific and is placed into other trades.

5. Geopolitical Risks: Ongoing tensions in the Middle East and potential disruptions in the Strait of Hormuz pose risks to shipping services. Any hope of the Suez Canal rebounding are put on hold at least through 2025.

6. Global reliability improving slightly but not yet near the performances pre-2020.

Market Trends and Insights

The global ocean market is experiencing a mix of challenges, including capacity oversupply, tariff adjustments, and regional congestion. The market dynamics are characterized by:

- Softening growth and tariff fluidity putting capacity and demand in flux.

- Added capacity on Transpacific turning to oversupply due to fast drop in demand & rates fall.

- Excess capacity supporting global rates are trending lower.

- Many GRI & PSS announcements made by carriers to start end of July or early August in many trades but likely they will not stick.

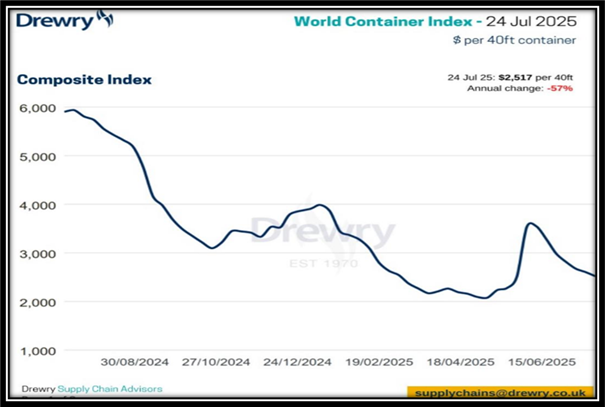

GLOBAL RATES TRENDING DOWNWARD

Major Trade Lanes

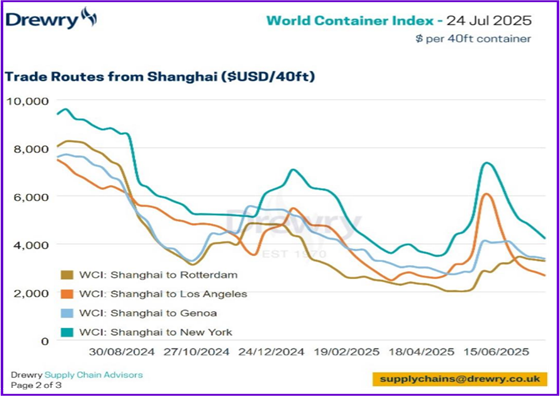

Asia to Europe

- Rates are up 30% since December and 60% higher than one year ago. Rates may have flattened out in July but still may climb higher.

- Capacity is tight due to strong demand and continuing Red Sea diversions, with vessels being routed around Africa.

- Equipment shortages, chassis and containers, have been happening in various parts of Europe.

- Long-term, expect rates to normalize lower once Red Sea traffic resumes, potentially leading to overcapacity.

Transpacific Eastbound to US & Canada

- US import bookings fell 12.15% week-over-week and 22.37% year-over-year in April but ramped up in May.

- Rates are trending lower with expectations that the Peak Season has already been completed before it normally would start. Tariff issues are the big unknown as to the overall impact on trade and costs.

- Peak season started and ended earlier than usual, pushing rates past the $7,000 to 8,000/FEU mark in June for many, but now just a few weeks later, down by almost half.

Indian Subcontinent to Europe and US East Coast

- Capacity to the US East Coast has increased, with July marking the start of the traditional peak season.

- Capacity to the US West Coast is available again.

- GRIs and PSSs were announced for the second half of July, but implementation has sputtered and then died.

Rest of the World

- India and Southeast Asia: Demand for ocean freight is slowly increasing due to recovery in production and exports.

- Middle East and South Asia (MESA): Tonnages were down 3% week-over-week, with spot rates down 4%.

Port Congestion Update

Asian Ports:

- Singapore: Congestion has somewhat eased, but vessels are still waiting up to 7 days for berths. Nearly 200,000 TEU on 21 vessels are currently anchored, awaiting berth space.

- Port Klang, Malaysia: Waiting times have increased to up to 5 days, more than double the wait posted in mid-June.

- Shanghai, China: Waiting times are up to 3 days, down from 4 days previously. Weather-related work stoppages and high vessel traffic contribute to congestion.

- Ningbo, China: Delays of 2-3 days due to congestion and high vessel traffic.

- Colombo, Sri Lanka: Delays of up to 3 days.

- Dubai: Delays of up to 3 days.

North American Ports:

- US West Coast:

- Los Angeles & Long Beach: Dwell time 4-8 days, rail dwell 3-4 days.

- Prince Rupert: Rail dwell 4-5 days.

- Vancouver: Rail dwell 3-4 days.

- US East Coast and Gulf ports: Reporting various levels of vessel waiting time at New York, Charleston, Norfolk, Savannah, Miami, and Houston. From New York with 6+ hours over average waiting time up to Savannah with 24 hours of vessel waiting time.

European Ports:

- North Europe ports continue to report different severities of congestion and backlog including Antwerp, Rotterdam, Hamburg, Bremerhaven, and to a lesser extent, Felixstowe.

- Backlogs reported and main Mediterranean ports also.

Latin American Ports:

- Manzanillo, Mexico: Congested with 5 vessels at port and 25 arriving.

Global Port Congestion:

- Port congestion remains a significant challenge with the worst generally in North Europe.

Conclusion

The global ocean market is experiencing a complex mix of challenges, including capacity oversupply, tariff adjustments, and regional congestion. Port congestion remains a significant issue. As the market continues to evolve, it's essential to stay informed and adapt to changing conditions.

WOWL is here to support your logistics operations from end to end. With our expertise and resources, we can help you navigate the complexities of the global ocean market and find the best solutions for your business. Whether you need assistance with capacity management, rate optimization, or port navigation, we're here to help. Let's work together to ensure your logistics operations run smoothly and efficiently.