US importers are again caught off guard by new tariffs on shipments already in transit. This is leaving them scrambling to adjust and absorb new costs or potential losses.

The recent agreement made with Vietnam has added to the confusion, particularly with unclear rules on transloading China-made products. This is leaving importers in a state of limbo, as well as the suppliers in Vietnam. The lack of clarity on these rules, combined with the normal complexities of rules of origin and 'made in' labeling requirements, is causing widespread concern. The fact that shipments are already in transit when tariff changes are announced is a game-changer, leaving importers with no opportunity to adjust plans or mitigate the impact.

Asia shipments bound for the US East Coast and many to the West Coast will arrive after the new tariff deadlines take effect (1 August). The uncertainty and fear of the consequences are mounting. The absence of clear guidance from the US Customs and Border Protection (CBP) is exacerbating the situation, leaving importers to navigate a complex and potentially costly landscape with little visibility or control.

Changes Since the Last Report (June 17)

- On July 2, the US had reached agreement on a framework of a trade deal with Vietnam. This involves 20% tariffs on Vietnamese exports to the US, and 40% tariffs on goods suspected of being transshipped from China.1

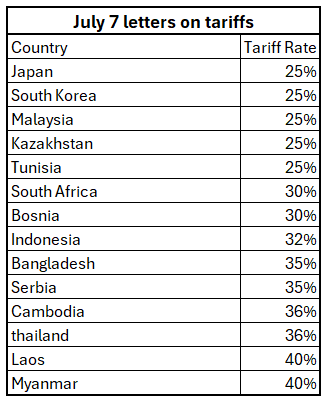

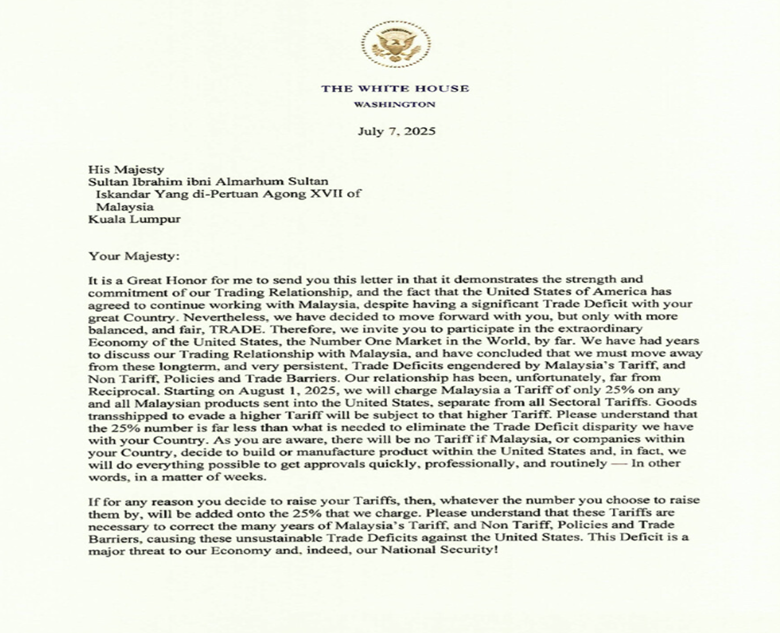

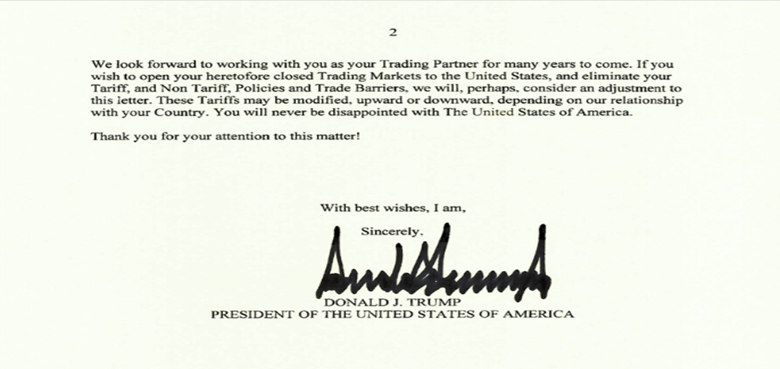

- July 7 Letters: The White House sent letters to 14 countries outlining new tariff rates:

- Assumptions are that these tariffs apply to the same scope-of-goods imports as the “reciprocal” April 2 tariffs: that is, they apply to most goods, but with specific commodity carve-outs.

- Letters to more countries are to come out over the next few days.

Prior Tariff Update:

China: A temporary 90-day truce is in place until 12 August, freezing US tariffs on Chinese goods at 55% and China's retaliatory tariffs at 10%.

UK: The US and UK have announced a new trade agreement that reduces tariffs on certain British imports, including aerospace, cars, and metals. The agreement awaits finalization.

Canada and Mexico:

- USMCA Treaty: Qualified trade within the rules of the treaty are still duty-free, with some exceptions like steel and aluminum.

- Most non-USMCA imports from Mexico and Canada are subject to a 25% tariff.

- The US and Mexico are nearing a deal to allow Mexican steel to enter duty-free or at reduced rates. The 50% tariff on steel and aluminum imports from Canada and Mexico remains in effect since June 4, 2025.

- Auto Tariffs: 25% tariff on imported cars and auto parts, with some exemptions.

Conclusion

This process of remaking the entire US trade program country by country is not happening fast. More confusion unfortunately will be the standard, at least for a few more months. It’s best to stay close to what is happening, stay close to the news. If you do not have a strong customs and trade partner, this should be a priority.

And if you do not have a strong internal customs and trade team, that is another recommendation. You need internal expertise as an importer or global supplier.

Sign up for a WOWL demo. You can see how WOWL adds to your logistics and supply chain expertise intersecting into your trade compliance and operations.