The global trade environment is experiencing significant changes, driven by the US president and the changing US trade policies. This article attempts to provide an in-depth analysis of recent tariff updates, trade agreements, and other developments to date.

Changes are being made as I write this and even agreements previously agreed. The South Korea-US agreement for example, was set and agreed weeks ago, yet has just changed again on Thursday (July 31).

1. Tariff Updates

The United States has implemented various tariff changes, affecting multiple countries and industries. Some key updates include:

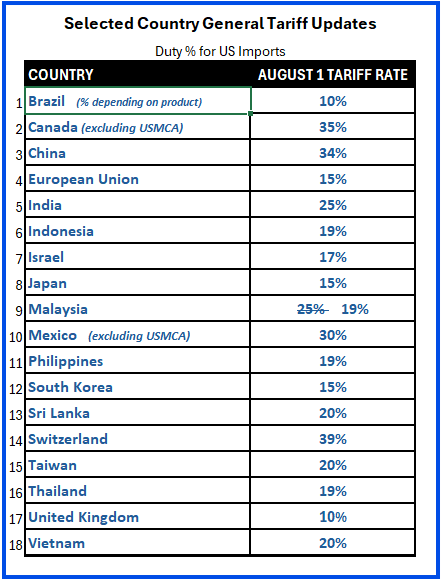

- Country-Specific Tariffs: Japan, South Korea, and Malaysia faced 25% tariffs, while other Asian countries are subject to 30-40% tariffs. Now they are all much less (see table below). Vietnam has a 20% tariff on direct shipments and 40% on Chinese-origin goods transshipped through Vietnam.

- New Tariffs: India faces a 25% tariff, effective August 1, while Brazil's tariff rate increases from 10% to 50%, effective August 6. Copper imports are subject to a 50% Section 232 tariff, effective August 1.

- Proposed Tariffs: A 10% tariff is proposed on BRICS countries, and a 200% tariff is proposed on pharmaceuticals.

2. Trade Agreements

The United States has recently finalized or announced several trade agreements, including:

- U.S.-Japan Deal: A 15% reciprocal tariff, $550 billion Japanese investment in the U.S., and reduced auto tariffs from 25% to 15%.

- U.S.-South Korea update: The agreement made earlier this month of 25% tariffs on imports into the U.S. revised more favorably for South Korea at 15% aligning with other competitive trading partners, Japan, and the EU.

- U.S.-Philippines Deal: A 19% reciprocal tariff.

- U.S.-Indonesia Deal: A 19% reciprocal tariff on Indonesian goods, with no tariffs on U.S. goods entering Indonesia. Indonesia will eliminate digital service taxes, pre-shipment inspections, and export controls on critical minerals.

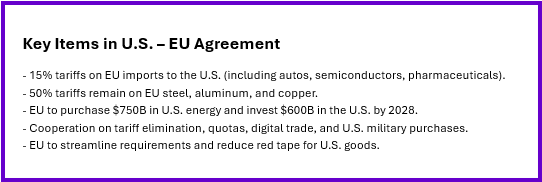

- U.S.-EU Trade Agreement: The EU will eliminate duties on U.S. exports, while the U.S. will impose a 15% tariff on EU imports. The agreement includes EU purchase commitments and other concessions, with full details not yet made public.

3. US-China Negotiations

US-China trade talks are ongoing, with both sides seeking to extend a 90-day temporary tariff agreement set to expire on August 12. The current tariff truce has reduced US tariffs to 30%, while China's tariffs have been reduced to 10%. The outcome of these negotiations are seen as most critical to global markets and trade relations. All will be watching this situation very closely.

4. Other Key Tariffs on Key Countries

- India: 25% tariff as of August 1; with additional penalties for Russian military and energy purchases.

- Brazil: Tariffs rise from 10% to 50% effective August 6.

- Taiwan: 20% tariff

- BRICS Countries: Proposed additional tariff of 10%.

- Reciprocal tariffs for over two dozen trade partners are yet to be confirmed.

For full list of countries and reciprical tariffs use this URL https://www.whitehouse.gov/presidential-actions/2025/07/further-modifying-the-reciprocal-tariff-rates/

5. Key Information, IEEPA tariff effective August 7, 2025

Ø Shipments departing by or before August 6 and clear U.S. Customs no later than October - 5 will be exempt from the new tariff s. Shipments that depart after August 6 are subject to the new tariff rates.

Ø The new tariffs apply in addition to existing Column 1 duties, except where noted. Verify your situation for each of your products / harmonized tariff codes.

Ø Countries listed such as UK, Vietnam, Indonesia, Philippines, Japan, and South Korea (see list) in the new Executive Order are subject to the new IEEPA tariff rates.

Ø If the Column 1 rate is below 15%, an IEEPA tariff will be added to bring the total to 15%. If the Column 1 rate is above 15%, only the Column 1 rate applies (no additional IEEPA duty).

Ø All Other Countries Not Named in the Executive Order will be subject to a 10% across-the-board IEEPA tariff.

- USMCA / Canada & Mexico?

Products and materials covered by the USMCA treaty maintain their zero tariff duty levels as long as they qualify. For both Canada & Mexico, those products that do not meeting USMCA or covered under other rules like for Canada it is aluminum, steel, and vehicles, which will likely face duties shown above.

The issue with Mexico has been cited by Mr. Trump as drugs and illegal migration. Trump is pushing Mexico on reducing both issues and be faced with a much higher tariff on non-USMCA qualified trade.

President Trump issued a new Executive Order announcing updated IEEPA tariff rates that will take effect on August 7, 2025. Below is a summary of the key changes and what they may mean for your shipments.

- Industry & Sector-Specific Tariffs

Certain industries subject to specific tariffs:

- Pharmaceuticals: A proposed 200% tariff, with a 12-18 month grace period for companies to relocate manufacturing to the U.S.

- Copper: A 50% Section 232 tariff, effective August 1, applying only to copper content.

- Steel and Aluminum: 50% tariffs in effect, with UK-origin exceptions.

- Additional tariff on BRICS countries proposed: 10% tariff on BRICS countries.

- For pharmaceuticals, proposed is a 200% tariff.

8. Investigations and Regulatory Actions

The U.S. government is conducting various investigations including:

- Section 232 Investigations: Probes into polysilicon, unmanned aircraft systems, and pharmaceuticals.

- Litigation is pending on the International Emergency Economic Powers Act (IEEPA) President Trump is using for many of the tariff changes.

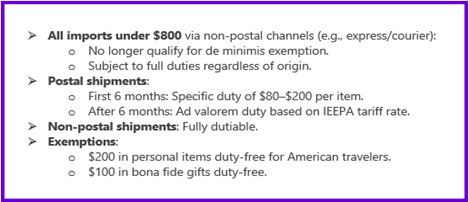

9. US De Minimis Exemption Ends

The de minimis exemption for low-value shipments will end on August 29, 2025. After this date, all imports under $800 will be subject to full duties, regardless of origin.

The new budget bill just passed into law had eliminated the De Minimis exemption by mid-2027. President Trump, using Executive Order, advanced the elimination to August 29, 2025, instead.

Note that the US suspended the de minimis exemption for Chinese-origin goods on May 2, 2025.

Closing

The global trade landscape is rapidly evolving, with significant changes in tariff policies, trade agreements, and regulatory actions. Importers and exporters must stay informed about these developments to manage budgets, optimize their supply chains, and minimize costs. As the trade environment continues to shift, it is essential to monitor updates and adjust strategies accordingly.

We will keep providing these updates to help you fill in the gaps.

Look to WOWL as your partner to manage your partners in logistics!

Andy Gillespie AndyG@WOWL.io