Opening snapshot

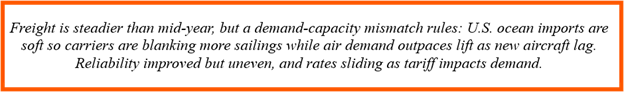

As October begins, the ocean market is calmer but softer. Rates generally dropping so carriers are responding with deeper October blank sailings. Double-digit capacity trims on key trade lanes including the TransPacific and Asia-Europe. But it’s not clear these blanks will steady prices.

In the U.S., consumer confidence eased and import demand appetite looks cooler into Q4. Overlay weather and policy noise like some major South China typhoons, Red Sea diversions, the U.S. fees on China-linked vessels as well as China responding with reciprocal penalties and you get a market that may be unpredictable week to week, and uneven by lane.

Key market points

Ø Cargo demand & rates

No pre–Golden Week surge; trans-Pacific spot rates keep slipping, with carriers and NVOCCs are cutting October prices.

Ø Carrier capacity moves

Carriers are ramping up October blank sailings—about 12–15% cuts on Asia North America, but it may not stop the rate slide.

Ø U.S. demand signal

Consumer confidence dipped in September (94.2), imports remain soft, and volumes likely weaken further into Q4 2025.

Ø Regulatory costs & carrier response

With the Oct 14 USTR port fee coming, CMA CGM, COSCO, and OOCL say they will not pass on these new charge to customers. China has already instituted reciprocal penalties on such fees on China made vessels and shipping lines using them.

Other top issues to keep your eye on

- Ocean demand is soft; announced GRIs have a hard time sticking.

- Golden Week capacity cuts are deep; more ad-hoc blanks are possible.

- China introduced new maritime measures that could shape how lines position capacity.

- South China terminals and Hong Kong experienced storm-related closures; lingering backlogs are working through the system.

- Red Sea/Suez risk remains; many strings still route via the Cape, stretching transits. Panama operations are closer to normal than earlier in the year.

- Rhine low water continues to limit some barge moves, pushing more cargo to rail/road.

- USWC vs USEC split persists: the West Coast is generally a buyer’s market; the East/Gulf are tighter in places.

- North America intermodal remains mixed—lane changes and service adjustments require flexible door planning.

- Mexico’s corridor disruptions earlier this month highlight the need for buffer on cross-border routings.

- Localized U.S. operational incidents (e.g., container loss, terminal closures) can ripple into dwell and appointment availability.

- Air cargo demand is inching ahead of lift on Asia-westbound lanes; aircraft delivery delays add medium-term tightness.

Trade-lane snapshots (now & next 6–8 weeks)

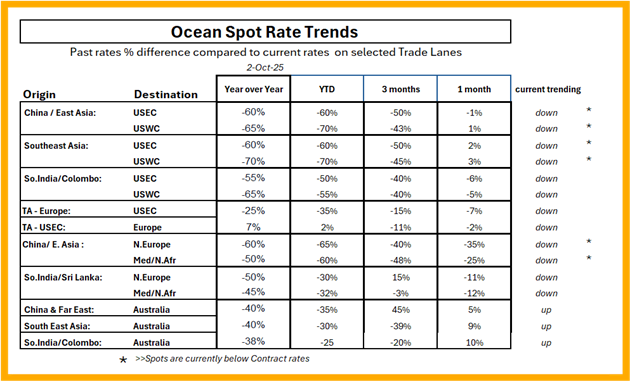

Transpacific | East & Southeast Asia → North America West Coast

- Demand: Soft/steady-soft.

- Supply: Adequate despite blanks.

- Vessels & equipment: Generally available; minor storm spillovers.

- Spot rates: Easing lower; favorable for non-urgent freight.

- Outlook: Sideways to slightly down; reliability slowly improving.

Transpacific | East & Southeast Asia → North America East & Gulf

- Demand: Softer than seasonal.

- Supply: Tighter than WC due to longer rotations and more blanks.

- Vessels & equipment: Mostly fine; inland timing matters.

- Spot rates: Firmer than WC but gently easing lower.

- Outlook: Stable/soft; book earlier for schedule confidence.

Asia → North Europe & Mediterranean

- Demand: Soft.

- Supply: Managed via cancellations.

- Vessels & equipment: OK at hubs; inland barge limits persist.

- Spot rates: Drifting down.

- Outlook: Sideways with inland variability; add buffer.

Indian Subcontinent (ISC) → North America

- Demand: Stable to soft.

- Supply: Adequate.

- Vessels & equipment: Balanced; transshipment timing sensitive.

- Spot rates: Flat to slightly down.

- Outlook: Sideways; watch Cape routings for transit stretch.

ISC → Europe & Mediterranean

- Demand: Soft.

- Supply: Adequate.

- Vessels & equipment: Generally available.

- Spot rates: Gently down.

- Outlook: Flat/soft; inland Europe remains the swing factor.

East & Southeast Asia → Australia

- Demand: Mixed; e-commerce/tech pockets firmer.

- Supply: Adequate.

- Vessels & equipment: Generally available.

- Spot rates: Flat to slightly up on select lanes.

- Outlook: Mostly stable.

Transatlantic | Europe → USEC (Westbound)

- Demand: Stabilizing after a long slide.

- Supply: Adequate.

- Vessels & equipment: Available.

- Spot rates: Stabilized at low levels.

- Outlook: Sideways with mild downside risk.

Transatlantic | USEC → Europe (Eastbound)

- Demand: Balanced.

- Supply: Adequate.

- Vessels & equipment: Available.

- Spot rates: Soft/flat.

- Outlook: Stable.

Port & gateway watchlist (3+ day delays reported in late September)

- South China & Hong Kong: Weather closures created 5–7-day ripples; recovery under way.

- U.S. West & East Coasts: Long Beach/LA and key USEC gateways show intermittent dwell and rail delays; Houston has seen longer turn times.

- North Europe: Antwerp/Rotterdam/Hamburg experience periodic queues; London Gateway, Southampton, Valencia, and Piraeus report high utilization and multi-day delays at times.

- South Asia & SE Asia: Colombo and Ho Chi Minh City note congestion and higher terminal utilization, with occasional vessel waits.

Air freight — quick view

- Demand is gradually outpacing available lift on Asia-westbound lanes heading into Golden Week.

- Weather-related flight cancellations in South China created short-term backlogs that are clearing.

- Aircraft delivery delays keep medium-term capacity tight; expect firmer peaks on tech and e-commerce flows.

Conclusion

October begins as September did with a familiar pairing of carriers issues: soft ocean demand and the need to discipline capacity. That combination points to gentler pricing but continued schedule juggling, especially around blanks, weather, and policy headlines. Reliability is inching forward, though inland Europe and occasional North American pinch points still require buffer. In the air, selective tightness persists where demand is strongest and lift is limited.

The practical playbook for October: book earlier on tighter lanes, use West Coast economics where they work, add 5–7 days around storm-hit hubs, and keep options open on inland moves. WOWL will continue to manage providers, measure performance, and keep watch over every handoff so your network performs the way you intend.

Demos are easy to setup for you. GO to WOWL.io or email me - AndyG@WOWL.io