Global Ocean & Air Freight — Update for Nov 6, 2025

Ocean markets continue to remain actively flux. Spot ocean rates jumped higher this week with new carrier GRIs published. But expectations of many are that these GRIs will trim back lower or fail. We will know in the next week.

Schedule reliability is holding at the high 50s to 65% level, better than last year, but as usual for the ocean carriers vary greatly in their performance levels (50% to 90% range) and between trade lanes and service strings. Red Sea detours via the Cape continue to tie up capacity as all ocean watchers anticipate return to Suez finally in 2026 . And the new U.S.–China “reciprocal” port fee arrangements are adding new cost and plenty of confusion to carriers, NVOs and the customers!

Top 10 things that matter

- New GRIs in November: Carriers are filing GRIs as fast as they can and hoping they will stick. If not sticking, then hoping that part of the GRI % will hold.

- Reliability ≈ 58%-65%: Better than 2024, but big gaps remain between best and worst networks. Big variation by carriers and service strings. Watch them carefully.

- Red Sea detours persist: Many carrier service strings still using the Cape of Good Hope routing instead of Suez. Expect another six months of peace before any big shift back to Suez.

- Suez restart will flood real capacity onto the Asia/Med/Europe markets and to lesser extent for East Coasts of the Americas.

- Panama: water levels good but throughput not yet normal: Conditions improved since 2024, but transit volumes are low.

- U.S.–China port fees started October: New charges apply based on vessel build/ownership/flag; China retaliated with its own fees. Expect more transshipment and string adjustments. Also, expect more China/US tweaking of terms and fees.

- North Asia weather/queues: Qingdao shows 2-4 day delays waits and Shanghai with 2-3 day delays.

- Colombo congestion: Transshipment volumes at Colombo causing some shifts to bypass that transit port temporarily.

- Air cargo steady volumes: September global demand +2.9% compared to last year.

- Oversupply vs. discipline: The ocean carrier orderbooks are large with many new builds coming online through the next few years. Carrier expected to creatively use blank sailings and other “capacity filling” methods to try to keep rates higher or holding.

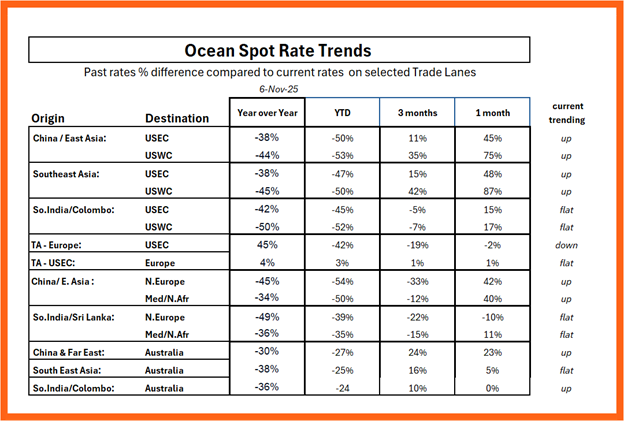

Rate trends by major trade lanes

Still expecting a general flattening and somewhat lower rates next 3 months.

Ocean Trade Lane check (for next 3 months)

A) Transpacific Eastbound (Asia→N. America)

Capacity: Adequate, with blanks to match bookings; some vessel reassignments amid fee/work-around planning.

Rates: Trending higher on new GRIs; near-term should flatten out now and hold if the carriers maintain discipline in their ranks with likely softening demand.

B) Far East Westbound (Asia→Europe/MED)

Capacity: “Effective” tighter due to Cape routing; service reliability continues to vary a lot by carrier with much impact from port congestion issues.

Rates: Range-bound with small uptick from bad weather and continuing labor issues.

C) Intra-Asia

Capacity: Competitive which is the norm for Intra Asia for rates as well as services.

Rates: Flat to slightly lower except any possible port/hub congestion flares.

D) India Subcontinent → U.S.

Capacity: Generally open; but watch possible impacts from FE strings.

Rates: Flat to softer expect with U.S. GRIs likely to falter.

E) India Subcontinent → Europe

Capacity: Stable; Europe ops/weather are the swing factors.

Rates: Flat, with modest upside if North Europe congestion wobbles again.

F) Asia → Australia

Capacity: Plentiful; carriers attempting at restoration to stem declines.

Rates: Flat to slightly higher especially if vessel utilization improves.

Major Ports with >2-day operational impact (recent)

- Antwerp-Bruges (BE): Backlogs from October pilot actions; gradual recovery still rippling into early Nov.

- Rotterdam (NL): Labor strike and weather caused multi-day vessel delays; related effects linger.

- Qingdao (CN): 3 to 6 day waits from bunching/weather.

- Shanghai/Yangshan (CN): Often ~2–3 days average wait reported.

- Colombo (LK): Yard congestion/transshipment surge; some services bypassed.

Airfreight snapshot

- Global: Sept demand +2.9% YoY; growth slowed vs. Aug.

- CN/HK → NA/EU: Firmer around tech/e-com peaks; capacity OK but tight near cut-offs.

- ISC → US/EU: Mostly open; surcharges pop up around festivals/short weeks.

30–90 days: Stable with pockets of firmness tied to ocean schedule risk and holiday pushes per IATA.

30–90 day outlook

- Ocean: Demand softening and carriers react with various blank sailing strategies expected to increase. GRIs could hold if carriers maintain discipline together on capacity. If bookings soften further rates expected to weaken again on major trades. Reliability to continue unevenly with slight improvements offset by increased blank sailing adjustments. Should be better performances compared to the last five years but not yet as good as pre-Covid levels.

Practical moves for shipper/BCO/importers

- Buy reliability, not just price. Look at the total value of the carrier or NVOCC you are working with.

- Analyze closely your rates and total landed costs but now include US-China vessel port fees where they are applicable. You need to know vessel build/flag/ownership for US-China shipments now.

- Book around known blank sailings: Pull POs ahead or have alternative routings ready.

- Panama Canal delays: Better than 2024, but not yet smooth working order either.

November is noisy but so was October and every other month this year! Stay nimble, book smart, shift and adjust the best you can. Rates may wiggle; plans don’t have to: GRIs come and go, good routings and carriers stick, and when ocean stumbles, step into the air.

We’ll watch the chokepoints, that’s what WOWL does. And we will pull in the data, the tracking, the bookings, and arrivals. We keep things moving for you. You take care of your customers; we will watch over your providers.

Check out our Blog at WOWL.io

Want to know more about what WOWL is? WOWL.io AndyG@WOWL.io