Snapshot

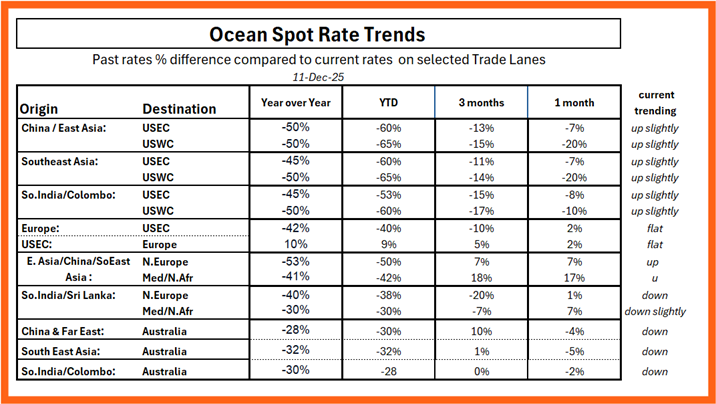

Global freight is ending 2025 with mostly soft rates and plenty of ships. U.S. import demand has dipped to its lowest level since June 2023, and carriers are leaning on blank sailings to keep vessels full. Asia–Europe, Mediterranean, and intra-Asia trades are firmer but still far from a boom. Airfreight out of Asia is busy yet controlled. Volumes and capacity are both about 5% higher year-on-year, while average rates are still below last year. Looking into 2026, a gradual return to Suez routings plus a heavy new-vessel orderbook will add effective capacity and keep a lid on ocean rate floors.

Key market points – top 5 issues

A. Soft but uneven demand

- Transpacific and Transatlantic imports are weak; Asia–Europe and intra-Asia are relatively firmer.

B. Overcapacity plus late capacity cuts

- Far East→USWC capacity rose ~7% month over month and Far East→USEC ~12% before carriers launched large blank sailing programs for weeks 50–01.

C. Suez reset will shape 2026 pricing

- Moving services back from the Cape of Good Hope to Suez will shorten voyages and release capacity, pressuring 2026 rates on Asia/ISC–Europe and ISC–USEC.

D. Congestion pockets drive real-world risk

- Hot spots include Northern Europe hubs, South China, Qingdao, Manila, Singapore, Port Klang, and main Australian ports, plus inland rail ramps in North America and Europe.

E. Airfreight firm but flattening

- Global air volumes and capacity are both up ~5% YoY; rates have climbed ~6% in the last month yet sit about 5% below last year.

Other top issues:

- Asia–Europe and ISC GRIs are sticking better than Transpacific increases have.

- Intra-Asia rates are edging up from a low base and react fast to any disruption.

- Oceania remains operationally tricky, with rollovers and skipped calls still common.

- Equipment is mostly available, but 40HCs are tight in parts of Southeast Asia and ISC.

- Airlines are profitable again and adding flights, supporting more capacity growth in 2026.

- Order books are very strong for new container ships while scrapping remains low!

Trade-lane snapshots (now & next 6–8 weeks)

Transpacific | East & Southeast Asia → North America West Coast

- Demand status: Soft; U.S. imports at their weakest since mid-2023.

- Supply status: Capacity up ~7% MoM, now being cut back through heavy blank sailings in weeks 50–01.

- Vessels & equipment: Space generally open; equipment available at main origins.

- Spot rates vs last 2–3 months: Below early-Q4 peaks and roughly 35% under the January carrier targets.

- Outlook (2–3 months): Shipper-friendly with choppy but short-lived GRIs.

Transpacific | East & Southeast Asia → North America East & Gulf

- Demand status: Stable but below mid-year levels.

- Supply status: Capacity about 12% above last month before blanks; some trimming under way.

- Vessels & equipment: Good availability; inland delays at select rail ramps.

- Spot rates: Slightly below 2–3 months ago and well under carriers’ January targets.

- Outlook: Sideways to softer; put more weight on schedule reliability in bids.

Asia → North Europe & Mediterranean

- Demand status: Slight pickup on restocking; Med stronger than North Europe.

- Supply status: High nominal capacity, but Cape routings and congestion keep things tight.

- Vessels & equipment: Many full sailings; berthing and feeder space limited at some hubs.

- Spot rates: Higher than October and early November, but momentum is easing.

- Outlook: Still relatively carrier-favored through Lunar New Year; more downside once Suez use normalizes.

Indian Subcontinent (ISC) → North America

- Demand status: Modest but steady as “China+1” sourcing grows.

- Supply status: Services open with selective blanking and call omissions.

- Vessels & equipment: Mostly balanced; some tightness on USEC/USWC services.

- Spot rates: Low with GRI attempts pushing up to 10% increases in mid-December; still though cheaper than Far East.

- Outlook: Gradual firming but remains a value lane for importers.

ISC → Europe & Mediterranean

- Demand status: Steady to firm across textiles and light manufacturing.

- Supply status: Many services; pricing, not space, is the main lever.

- Vessels & equipment: Generally balanced at major ISC ports.

- Spot rates: Higher than early Q4 yet still competitive vs China origins.

- Outlook: Normal, competitive market; good timing for multi-carrier RFQs.

East & Southeast Asia → Australia

- Demand status: Strong but lumpy; driven by retail and e-commerce.

- Supply status: Tighter than most trades; skipped calls and bunching common.

- Vessels & equipment: Rollovers and 2–3-day transshipment delays remain normal.

- Spot rates: Below the October spike but still elevated.

- Outlook: “Book early or roll” through Lunar New Year; reliability is the key risk.

Transatlantic | Europe → USEC (Westbound)

- Demand status: Flat to soft.

- Supply status: Ample capacity with only light blank sailings.

- Vessels & equipment: Balanced.

- Spot rates: Near lows compared with other trades but up over the past month.

- Outlook: One of the most shipper-friendly lanes; attractive contract window.

Transatlantic | USEC → Europe (Eastbound)

- Demand status: Steady, with no strong peak.

- Supply status: Plenty of ships and space.

- Vessels & equipment: No systemic issues.

- Spot rates: Flat at low levels trending slightly higher lately.

- Outlook: Stable; shippers retain strong leverage.

Intra-Asia

- Demand status: Healthy regional flows (China–ASEAN, intra-ASEAN, Middle East/Africa).

- Supply status: Adequate but very sensitive to hub congestion.

- Vessels & equipment: Sailings often full; tightness appears quickly when ports slow.

- Spot rates: Slightly higher than 2–3 months ago from a low base.

- Outlook: Driven more by port operations than global demand; hub choice matters.

Port & gateway watchlist

Key ports and gateways with roughly 2+ days of total delay (vessel wait, dwell, or inland ramp lag) include: Shanghai/Yangshan, Yantian, Qingdao, Manila, Singapore, Port Klang, Colombo, Sydney, Melbourne, Fremantle, Auckland, Nhava Sheva, Mundra, Kolkata, Jebel Ali, Los Angeles/Long Beach, SeaTac, Oakland, New York/New Jersey, Savannah, Chicago ramps, Rotterdam, Antwerp-Bruges, Hamburg, Southampton, Valencia, Piraeus, Tanger-Med, Santos, Callao, and Manzanillo (Panama).

Global Air Freight

- Demand & supply: Volumes and capacity are each about 5% higher than last year.

- Rates: Average spot rates are roughly 6% higher over the last month but still around 5% below 2024 levels.

- Outlook: Firm but “normal” into early Q1; good time to plan structured sea-air solutions rather than last-minute air.

Conclusion

Right now, price risk is lower than service risk. Use the soft rate backdrop to lock in your pricing with solid 2026 contracts, diversify routings and gateways, and watch the Suez transition closely. Small choices of port selection, carrier mix, mode split and a bit of extra lead time will protect your supply chain more than chasing the very lowest weekly spot rate.

Find out how WOWL manages and supports your logistics processes, providers, data, analytics and visibility with skilled global team with the best ever!

AndyG@WOWL.io

#OceanFreight #AirFreight #FreightMarketUpdate #SupplyChain #ITMS #OriginManagement #LogisticsStrategy #ShippingRates #2026Planning #WOWLInsights