Snapshot

Early January is a managed market: post-holiday demand is softer, but carriers are using blank sailings and schedule changes to prevent rates from sliding too fast. Space is generally available, yet weekly pricing can still move quickly when capacity is pulled.

A second theme is gaining momentum: a gradual return toward Red Sea/Suez routings. If this transition continues, it will be a major factor for Q2 and the rest of 2026 because shorter routings free ships sooner, effectively adding capacity and increasing downward pressure on rates.

Key market points

A. Demand: Mixed globally; U.S. import demand remains soft, with a modest seasonal lift possible later in January.

B. Capacity: Still plentiful versus demand. Carrier discipline—not demand strength—is driving near-term price and space conditions.

C. Suez/Red Sea: Return planning is real, but cautious. Expect mixed routings and a transition period rather than a fast switch.

D. Reliability: Local congestion and inland bottlenecks remain the main risk—more “pockets” than widespread global gridlock.

E. Spring Trans Pac contracting (Apr–May): Setup favors shippers. Overcapacity and a likely Suez normalization point to flat-to-lower contract levels and continued pressure on spot rates.

F. Contract vs spot: Contracts should stay more stable than spot but expect spot to swing above and below contract levels depending on blank sailings and disruptions.

Other top issues (next 10)

- Pre–Lunar New Year (LNY): Some tightening is possible late Jan, but impacts vary year to year—plan, don’t panic.

- Asia port friction: Congestion risk remains at key hubs (Singapore/Colombo/major China and India gateways).

- North Europe weather: Winter disruptions are affecting terminals and inland networks.

- Transatlantic: Demand is soft; rates remain under pressure versus prior years.

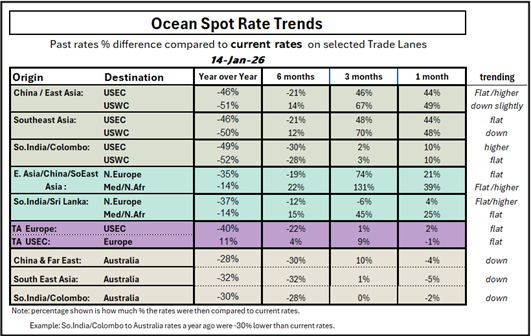

- Rates: Recent upticks are more tactical than structural; overcapacity keeps the medium-term bias softer.

- Network changes: More schedule reshuffles, alliance tweaks, and selective service changes as carriers chase utilization.

- Equipment: Positioning is uneven in congested regions and parts of inland Europe.

- Air: Post-Christmas lull now; late-Jan pre-LNY lift is likely.

- Air 2026: Growth looks modest; added capacity limits sustained rate strength.

- Trade policy/compliance: Ongoing tariff and regulatory changes continue to add planning friction for BCOs.

SUEZ WATCH (what to expect operationally)

- Near term (weeks): Mixed routings, selective trial transits, cautious normalization.

- Transition risk: Schedule whiplash and port bunching if multiple loops shorten too quickly.

- 2026 rate impact: As routings normalize, effective capacity rises—supporting a softer rate environment overall.

- Caution: Geopolitics can change quickly; reversal risk remains.

Trade-lane snapshots (now & next 6–8 weeks)

Transpacific | East & Southeast Asia → North America West Coast

Demand status: Soft; possible late-Jan lift ahead of LNY.

Supply status: High capacity, managed by blank sailings.

Vessels & equipment status: Generally available; reliability depends on hubs and rotation changes.

Spot rates trend: Firmer than the deepest late-Q4 points, but not supported by strong demand.

Outlook (2–3 months): Choppy—brief pre-LNY firmness, then softer post-holiday pattern likely.

Transpacific | East & Southeast Asia → North America East & Gulf

Demand status: Softer than USWC.

Supply status: Overcapacity remains; void sailings used to protect utilization.

Vessels & equipment status: Space generally available; inland performance drives total transit.

Spot rates trend: Stable-to-soft overall.

Outlook: Similar to USWC unless carriers cut deeper than expected.

Asia → North Europe & Mediterranean

Demand status: Firmer approaching LNY; utilization improving.

Supply status: Still influenced by port congestion; Suez expansion would loosen conditions over time.

Vessels & equipment status: Inland chassis/container constraints and weather can disrupt parts of Europe.

Spot rates trend: Some early-Jan firmness on key routes.

Outlook: Short-term volatility; medium-term bias toward softer rates as effective capacity expands.

Indian Subcontinent → North America & Europe

Demand status: Moderate; pockets of tightness due to fewer direct options and port congestion.

Supply status: Competitive but sensitive to blank sailings and transshipment reliability.

Outlook: Book early for critical cargo; watch hub connectivity and schedule changes.

Transatlantic | Europe ↔ USEC

Demand status: Soft; rate pressure continues into Q1.

Supply status: Space generally available; carriers managing oversupply.

Operational risk: Northern Europe weather and congestion events can disrupt schedules.

Outlook: Stable-to-soft pricing; reliability is the main risk.

Intra-Asia

Demand status: Seasonally active around LNY repositioning.

Supply status: Competitive; short-term pricing swings possible.

Outlook: Expect volatility, not a steady trend.

Port & gateway watchlist (last ~2 weeks)

- Far East & Southeast Asia: Congestion pockets at major China gateways and key hubs.

- Indian Subcontinent & Middle East: Hub sensitivity remains high; schedule compression can amplify delays.

- North Europe: Weather disruption affecting ports and inland moves.

Global Air freight — quick view

Demand: Easing from December peak; late-Jan pre-LNY rebound likely.

Supply: Capacity generally available early January; tighter pockets on priority lanes/programs.

Spot rates: Flat-to-soft early January; potential firming closer to LNY.

2026 outlook: Modest growth; rates face pressure if capacity expands faster than demand.

Conclusion

Keep the playbook simple: book early (3–4 weeks) for critical cargo, especially as we approach late January through mid-February. That window can tighten quickly due to pre-LNY timing plus carriers blanking sailings to manage utilization.

For 2026 planning, treat the Suez return as a major lever. If the shift continues without setbacks, it should increase effective capacity and support flatter-to-lower pricing overall. Expect a noisy transition—schedule changes and localized congestion—before networks settle into a more capacity-heavy baseline.

AndyG@WOWL.io

WOWL.io for more information or contacts and newsletters!